Orbital Infrastructure Growth and Its Unseen Impact on Connectivity’s Future Architecture

While much attention to the future of connectivity gravitates towards terrestrial and AI-driven networks such as 6G and 5G-Advanced upgrades, an under-recognised yet potentially transformative development lies in the rapid expansion and densification of low Earth orbit (LEO) satellite constellations. The increasing size, mass, and capability of commercial satellites—exemplified by SpaceX Starlink's iterative generations—may catalyse structural shifts in space governance, capital allocation, and network infrastructure models over the next two decades. This paper identifies the growth trajectory of mega LEO satellite systems not merely as incremental connectivity improvements for underserved areas but as a wild card for fundamental change in how digital infrastructure is conceived, financed, regulated, and operated.

Signal Identification

This phenomenon qualifies as a wildcard with medium-to-high plausibility and a time horizon spanning 10–20 years due to its dependence on multiple evolving factors—space launch costs, orbital traffic management, regulatory coordination, and commercial viability of space-borne data centers. It sits at the intersection of telecommunications, aerospace, environmental regulation, and national security sectors, exposing a broad ecosystem to potential disruption.

What Is Changing

The provided articles show Starlink’s satellite constellation as a critical vector for expanding digital infrastructure to rural and hard-to-reach communities (Microsoft, 24/02/2026). Notably, subsequent Starlink satellite generations are dramatically larger and heavier: from 575 kilograms for the V2 Mini Optimized to projected 2,000 kilograms for the V3 models (Engadget, 01/03/2026). This growth in mass and complexity implies a paradigm where satellites transition from simple relay nodes to sophisticated edge computing platforms in orbit, envisaged as "orbital data centers." Such infrastructure could process data closer to users globally, reducing latency and off-loading terrestrial networks.

Simultaneously, concerns arise around the increasing orbital congestion and debris generation ("a crematorium for satellites") threatening not only network reliability but the very operational environment of space (The Conversation, 01/03/2026). This environmental pressure represents an externality largely unpriced or unregulated today.

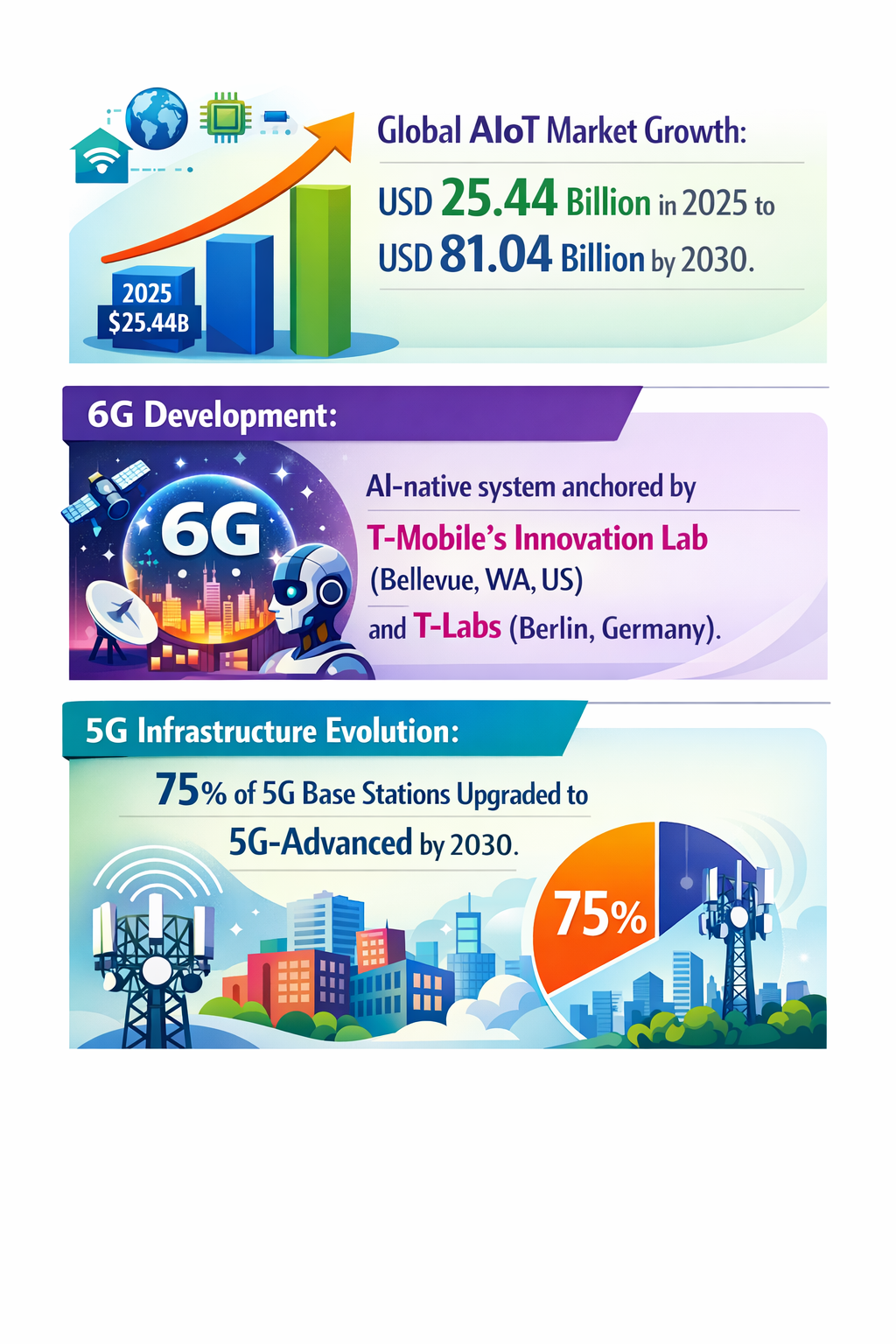

Unlike terrestrial 5G-Advanced or emergent AI-native 6G efforts—where upgrades may remain largely software-based (CCS Insight, 01/03/2026)—the leap in satellite mass and complexity embodies a materially different vector of infrastructure expansion outside conventional telecommunications industry controls. This orbital intensification is shaped by aerospace supply chains, launch vehicle economics, and international space law—domains traditionally disconnected from telecom capital deployment.

Disruption Pathway

The intensifying deployment of massive satellite constellations may integrate into terrestrial networks as high-capacity, low-latency orbital nodes, enabling truly global hyperconnectivity. As satellite capabilities evolve, operators might offer not only broadband but distributed edge computing services from orbit, directly competing with terrestrial cloud and edge data centers.

This escalation is contingent on continued reductions in space launch costs, advances in satellite on-orbit servicing, and miniaturization of AI hardware suitable for deployment in orbit. If these factors accelerate, they will increase both the volume and technological complexity of orbital assets, incentivizing deeper vertical integration between space operators, telecom providers, and cloud services—upending traditional industry boundaries.

However, the resultant orbital congestion and debris risk impose severe operational stresses. Collective action failure to implement robust space traffic management and debris mitigation may provoke regulatory overhauls or moratoria, disrupting existing industry plans and capital flows. Conversely, forward-looking governance models might demand liability frameworks for space collision damages, insurance regimes, and joint stewardship agreements, fundamentally transforming the risk profile of satellite-based connectivity.

If such governance emerges, commercial space infrastructure may become increasingly entwined with national security priorities and export controls, elevating geopolitical strategic concerns previously peripheral in telecom network planning (Ericsson, 01/03/2026). This could spur redefined industrial policies, incentivizing domestic satellite manufacturing, launch capabilities, and secure orbital data platforms.

Why This Matters

From a capital allocation perspective, the wildcard challenges existing investment paradigms by shifting significant infrastructure capex off-planet, diluting traditional terrestrial network asset value and operational control. Telecom operators may need to hedge terrestrial rollout risks with partnerships or ownership stakes in orbital infrastructure.

Regulatory authorities will face new governance demands, including orbital spectrum licensing, debris liability, and cross-jurisdictional enforcement. Failure to preemptively address these could stall rollout or raise compliance costs significantly.

Industrial structures might fragment as aerospace, cloud service providers, and telecom operators collocate in orbit-centric joint ventures or consortia. Competitive positioning will likely favour those able to integrate multi-domain competencies spanning space operations and terrestrial network orchestration.

Moreover, supply chains will become more complex as satellite manufacturing requires advanced materials, AI chips adapted for space, and secure launch and on-orbit servicing capabilities.

Implications

The growth of mega LEO constellations could likely catalyse a new infrastructure ecosystem blending terrestrial and orbital assets, driving new capital flows and cross-sector collaborations. It might redefine “network edge” from urban proximity to orbital vicinity, transforming latency and computational paradigms.

This is not merely an extension of existing satellite internet; rather, it could represent a discontinuity in network infrastructure geography and governance. However, competing interpretations exist: some may see the orbital congestion risk as a showstopper leading to regulatory clampdowns, while others may view it as manageable with evolving technologies and multilateral governance.

Consequently, actors should avoid conflating hype around 6G AI-native systems or terrestrial 5G-Advanced rollouts with the fundamentally distinct challenges and opportunities that orbital infrastructure scaling presents.

Early Indicators to Monitor

Patent filings related to on-orbit AI compute modules and satellite servicing technologies; regulatory drafts addressing orbital traffic and debris liability; concentration of venture financing in orbital edge computing startups; formation of international multilateral frameworks or alliances for space governance; procurement of commercial launch capacity for heavier satellites; and announcements of telecom-space joint ventures integrating satellite and terrestrial core networks.

Disconfirming Signals

Major setbacks in satellite launch reliability or cost reductions; international moratoria on satellite constellation expansion; widespread regulatory restrictions or bans due to space debris crises; failure of on-orbit AI compute demonstrations; stagnation or reduction in venture capital flows to space infrastructure; or sustained preference for terrestrial-only edge computing architectures in next-generation network planning.

Strategic Questions

- How should capital allocation strategies evolve to hedge between terrestrial and orbital connectivity infrastructure investments?

- What regulatory frameworks are necessary to proactively govern satellite constellation growth, orbital traffic, and debris liability?

- How might cross-sector industrial alliances in aerospace, telecommunications, and cloud computing reshape competitive dynamics?

- What risk management and liability strategies should be developed given the increasing complexity of orbital infrastructures?

- How can public-private partnerships be structured to balance commercial incentives with national security and environmental stewardship in space?

- What technological milestones in satellite AI compute and on-orbit servicing will determine the viability of orbital edge networks?

- How might terrestrial network operators need to transform their service architectures to integrate with orbital connectivity layers?

Keywords

Low Earth Orbit Satellites; Orbital Edge Computing; Space Debris Regulation; Space Traffic Management; Telecommunications Infrastructure; Starlink; 6G Networks; Telecom Industrial Strategy; National Security Space; Aerospace Telecom Alliances.

Bibliography

- Microsoft - Accelerates Telecom Return on Intelligence (24/02/2026)

- Engadget - AI Orbital Data Centers Risks (01/03/2026)

- The Conversation - New Space Race Concerns (01/03/2026)

- CCS Insight - 6G as Software-Only Upgrade (01/03/2026)

- Ericsson - 5G Dual Use and Security Ecosystem (01/03/2026)