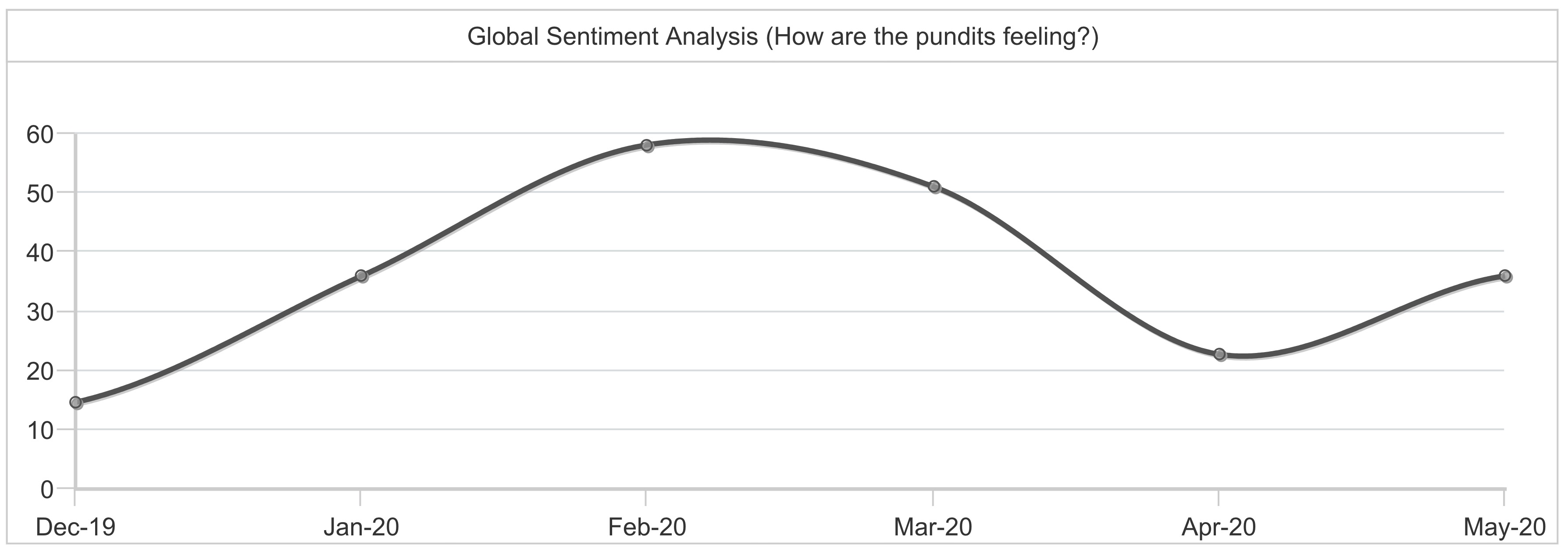

Global Sentiment Analysis (How are the pundits feeling?)

Sentiment Analyzer is a powerful and efficient solution that automatically extracts sentiments (positivity/negativity), opinion objects (e.g., product features with associated sentiment phrases) and emotions (like, excited, anger, disgust, etc.) in unstructured text data. The graph shows the net number of mentions of positive versus negative sentiments expressed in each period on a specific topic, gleaned from the thousands of forecasts being added to the service each month.

Global Sentiment is a coincident Indicator of emerging change. As pictured above it analyzes the mood of the pundits who are reporting on the future. Since pundits generally reflect the mood of society and change society's opinions it is a good indicator of people's current view of the future.

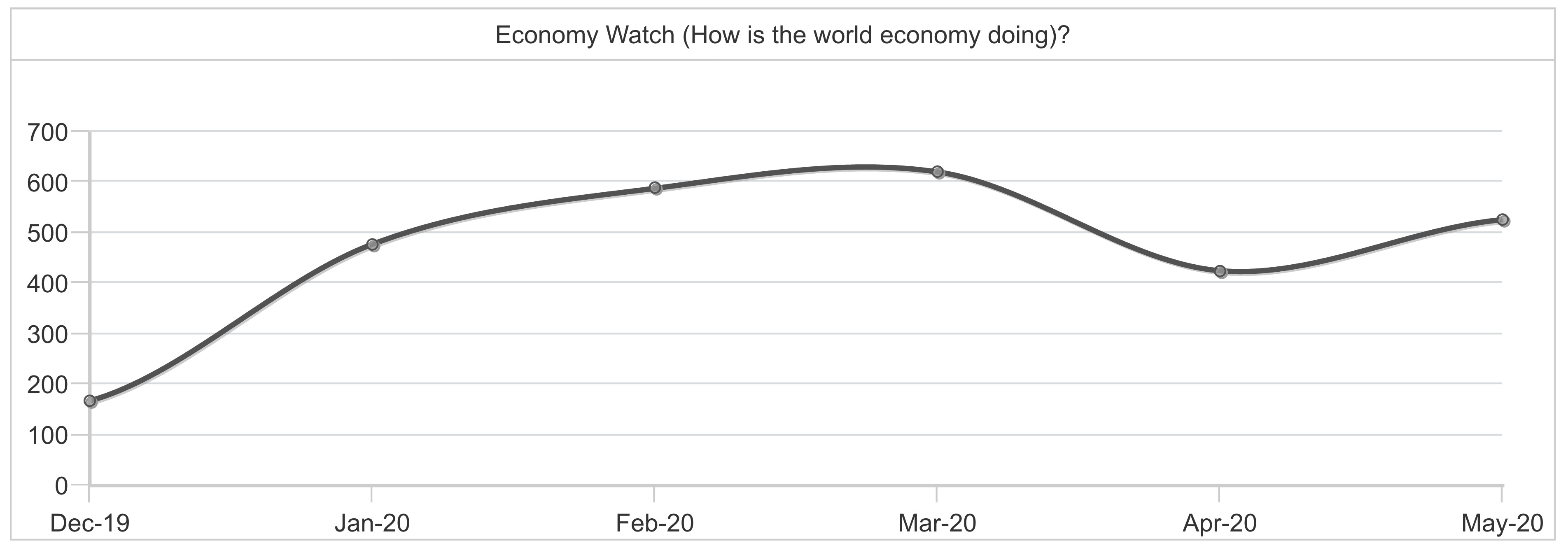

Economy Watch is a lagging indicator of emerging change. It auto-aggregates opinions of our 45,000+ sources on whether the global economy is likely to grow or decline in the near future. Get fast, up to the minute, handle on global optimism or pessimism and take action as you see fit.

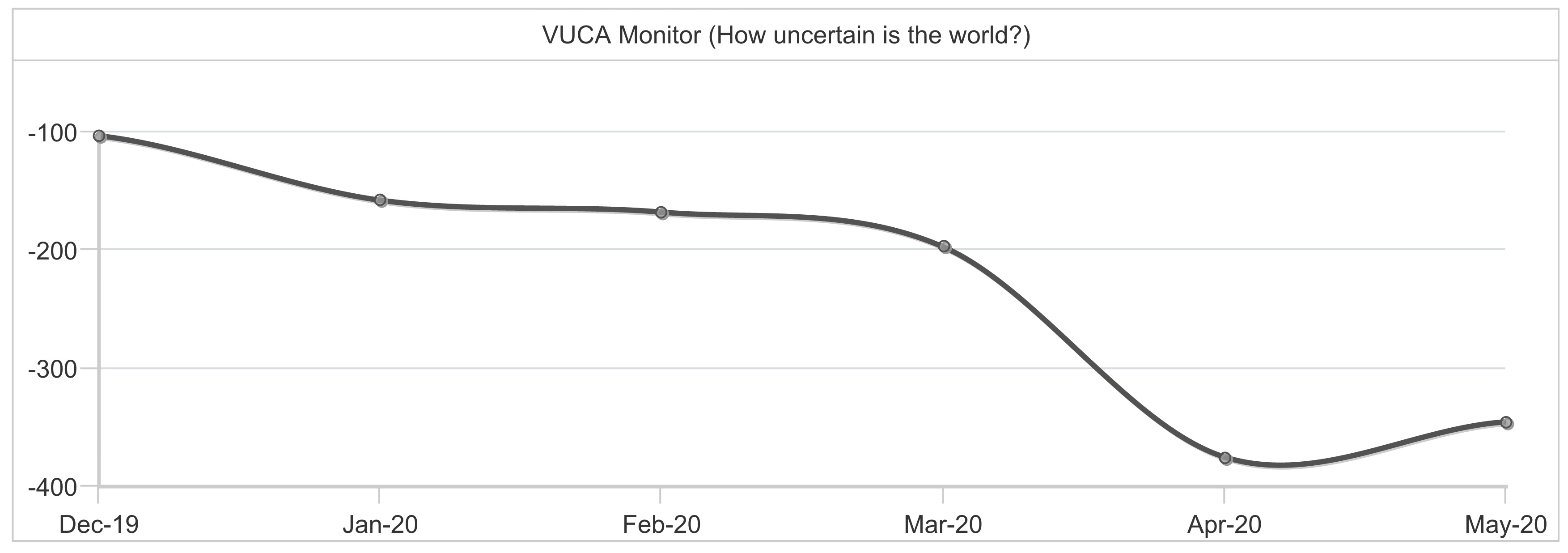

VUCA World is a leading indicator of emerging change. It describes whether reported volatility, uncertainty, complexity and ambiguity of general global current conditions and situations are getting better or worse. Movements up or down in this graph generally presage the same effect in the other two charts presented here, over time. Get fast, up to the minute, handle on global optimism or pessimism and take action as you see fit.

Summary: The combination of these three charts gives you an overall picture of where the global economy is heading. Right now, it's worsened dramatically due to the coronavirus outbreak and with degrees of uncertainty caused by heightened policy uncertainty, protectionist pressures, and risk of financial market disruptions. It feels like the balloon that's increasingly being stretched until it pops. The Global Sentiment chart seems to be presaging this possibility. The Economy Watch result now also is a cause for increasing concern. Sentiment has shifted rapidly due the coronavirus outbreak. Additionally, some of the key fears of the past few months, including a possible war with North Korea or Iran, have yet to resolve themselves and can rise again very quickly. This coupled with the high-risk combination of record debt, asset bubbles, low growth, potential trade wars, sanctions and nationalism, and limited scope for action has now seen the global economy spiral into a new crisis.

Although things appear to have bottomed out we place the probability of a global recession as high as 99 percent with growth halved. Time to build scenarios and determine your course of action in each scenario we think. Please contact us to find out how we can quickly help your team with this exercise.

Contact us to establish your own private, topic-specific sentiment analysis or search for your chosen keyword below.

Note: Slow load time for some topics due to the sheer volume of text to be analyzed. Please be patient. It's also why we restrict the results to the last six months. You can ask us to create graphs with longer timeframes out of peak hours.

Last update 4 June 2020